I asked the jeweler how she got their gross profit up by 5% over the past year. “We did two things; we increased our markup slightly in specific categories and price points and we clamped down on discounting.” And then she said, “And no one noticed but the bottom line.” That line was just too good not to share!

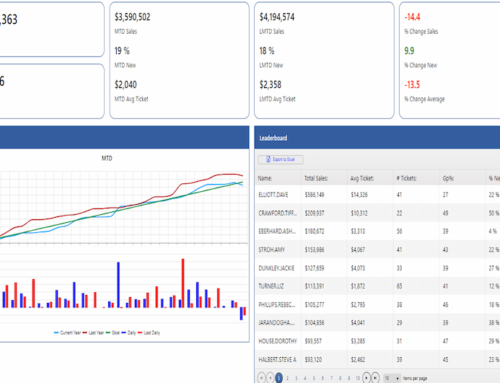

Improving your bottom line is a challenge for many retailers. We tend to follow the same patterns of behavior over time (years and even generations) and therefore, markup and discounting wind up becoming a part of our culture, rather than having a net profit strategy. We have an advantage in this area since we analyze dozens of retailer’s financial statements through our Plexus groups and can easily compare every line item of the P&L from Sales, Cost of Goods, Gross Profit and Expenses. When put side-by-side, it becomes immediately apparent which companies are driven by top line sales, compared with those who work to improve their bottom line.

Is it easy to improve one’s bottom line? No, it’s not easy. But it is infinitely easier when you understand how to read your financial statements and which levers to move (up or down) in order to get the results you are looking for. If your net profit is less than 5%, you have some work to do. If you are netting between 5 – 10%, you are pretty average, but moving your net profit up a point of two is certainly obtainable. The best retailers we work with put more than 15% of Total Sales to the bottom line (and for our purposes, feel free to remove depreciation from your numbers to see where you stand).

Unfortunately, accountants like to do things with financial statements, such as depreciate inventory for tax purposes that mask what’s actually happening in the business, and therefore, also masks what needs to be improved. Do you have a margin problem, or a discounting problem? You’ll never know if your accountant “tweaks” your numbers. If you are among those jewelers who are very comfortable with your financial statements, then you know how to undo creative accounting – including taking advantage of current tax strategies to lower your net profit. But this is not about lowering your tax bill, it’s about managing your company to improve your bottom line. And for that, you need real numbers, presented in a format that makes sense to you so you can understand which lever to move up or down.

And when you decide to move your gross profit up a few points and cut your expenses by a few points, I promise that no one will notice but your bottom line.