By Abe Sherman, CEO BIG

Raise your hand if you love to create budgets! No kidding, no one loves to create budgets. Well, there are those rare people who are just a little “different” and think that budgeting is fun (I know, because we have a few of them around here). But let’s be honest, most of us find the budgeting process intimidating, tedious or even frightening. So, let’s change that up a bit.

Instead, consider this question, “What is your Financial Vision”? Ah, ha! You’re a visionary, so you know how to have a financial vision! When you think about the budgeting process (work with me here) you have to look back at your history, sales and margin trends and changes in expenses, inventory levels and profit. Zzzzzzzzzz… So, don’t look back, look forward.

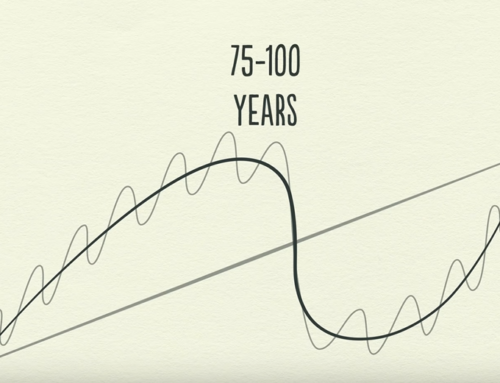

Let me explain. The conversation typically starts from one of two perspectives. The first is the client wants to improve net profit and the other the client wants to improve cash flow. These two subjects are not necessarily exclusive of one another (we can tackle both at the same time) but it’s just as easy to talk about one without the other. Cash flow, for example, has quite a bit to do with inventory management. While budgeting is supposed to have quite a bit to do with inventory management as well, something often gets lost in the budgeting process – the vision for what you want this to look like at the end of the year. Budgeting starts with what was, a Financial Vision starts with what you want it to look like. I think these are very different thought processes.

A quick example

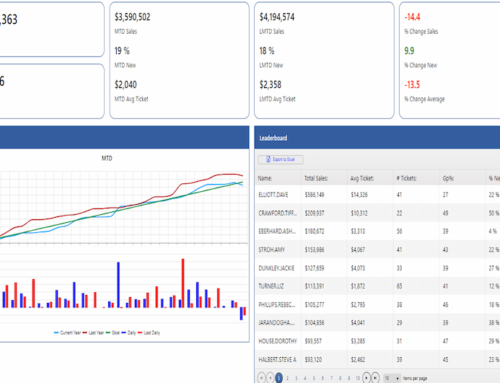

As a quick example, take a look at how much owned inventory you have in stock. How much debt do you have? Is it long term bank debt or line of credit plus accounts payables? If your debt is higher than you’d like you have one more number to check out – your aged inventory. Just for fun, compare your aged inventory to your debt; how close are these two numbers? Take a look at your Cost of Goods Sold; how much more inventory do you have than your COGS?

Our industry turns inventory somewhere in the .78-.80 range. And while many jewelers do much better than this, many do not. A .80 turn means for every $80,000 you sell (at cost), you have $100,000 in inventory at cost. If your bills are paid, you have money in the bank and have no cash flow issues, stop reading, you’re doing great.

Try this exercise

But if you are among the thousands of jewelers who have more debt than they would like, try this exercise. What is your Financial Vision for your inventory at the end of this year? Don’t expect sales are going to increase, don’t expect margins to increase and don’t expect your expenses to decrease – in other words, for this exercise, just think about your inventory. That’s it. Go ahead, I’ll wait….

Bam! So you have decided that by the end of this year, you are going to lower your (owned) inventory by $200,000. This money is going to be used to pay down debt, or build cash, invest in a new line or pay out distributions, whatever, but the fact that you have that singular vision in mind cuts out a lot of the intimidation of the budgeting process. Does this mean you should not create budgets and plans? No, not at all. The point I am making is that so many people don’t start the budgeting and inventory planning processes because they think it’s too much work or it’s too intimidating, so no part of that process gets done. If you can produce budgets, by all means, go for it. But if you cannot, for whatever reason, don’t let that stop you from having a vision.